Despite a $10 million payout to Jim “Mattress Mack” McIngvale, Penn Interactive managed to eke into profitability during Q4 of last year. Penn Entertainment credited the strong performance of TheScore in Canada as well as solid launches in Kansas and Maryland for Barstool Sportsbook.

Net income down substantially from 2021

While net income was down 46% from 2021, it was still a solid finish for the company, which posted $468.3 million in adjusted EBITDAR, which was relatively flat from last year. The company cited a rough spell of weather in December as well as economic headwinds for the numbers.

Here is a look at Penn’s top-line numbers:

Revenues: $1.59 billion, up .8% YoY

Net Income: $20.8 million, down 46% YoY

Adjusted EBITDA: $438.3 million, up 18.8% YoY

Adjusted EBITDAR: $468.3 million, down 2.6% YoY

“2022 was a solid year for PENN despite ongoing macroeconomic headwinds. I’m proud of PENN’s numerous financial and operational achievements in the past year as well as our continued progress on the ESG front,” said Penn Entertainment CEO Jay Snowden. “We remained focused on executing our leading omnichannel strategy, which drove database growth and further engagement with our expanding 21-44 year old cohort. Fourth-quarter revenues of $1.6 billion and Adjusted EBITDAR of $468.3 million were impacted by severe weather in certain parts of the country in December. Importantly, we also achieved profitability in our Interactive segment notwithstanding an unfavorable sports betting outcome in the World Series. The quarter ended on a high note with strong performance between Christmas and New Year’s across the portfolio, which has continued through January.”

The final quarter of 2022 will also be the last quarter that Penn Entertainment will not have the whole of the Barstool Sports media company on its balance sheet. The company will close on the complete acquisition of the brand on Feb. 17.

“Barstool achieved record revenue in 2022 while investing in and expanding into new verticals, including coverage of live sporting events such as the Barstool Invitational college basketball tournament on Nov. 11 and the Arizona Bowl on Dec. 30. The combination of Barstool’s vast, loyal audience with theScore’s fully integrated media and betting platform will provide us with compelling competitive advantages and organic cross-selling opportunities,” said Snowden.

theScore’s performance in Ontario “better than expected”

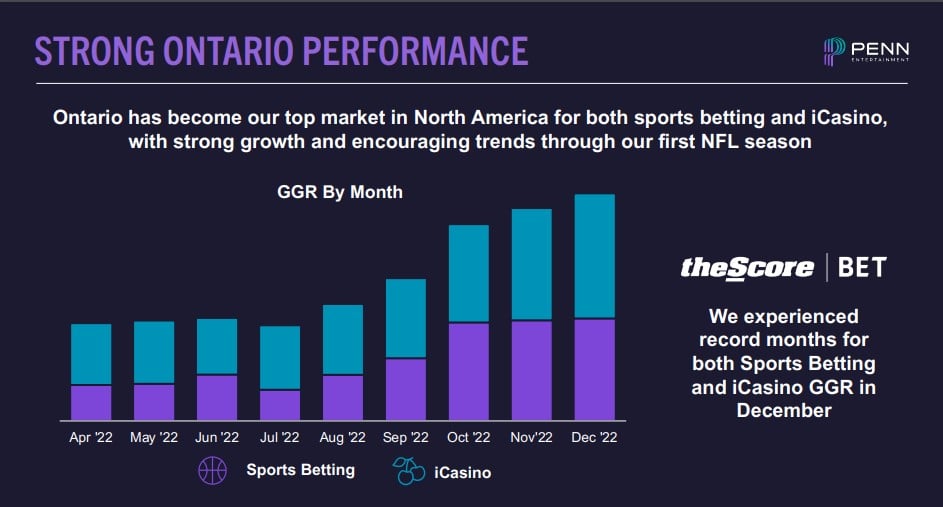

Barstool Sportsbook may draw the bigger headlines, but it was theScore that generated the most kudos during the earnings call. Results in Ontario were “better than expected”, particularly when it came to online casino.

“This was a huge year for us on the technology front as the migration to our own tech stack and Ontario was a tremendous milestone, and we could not be more pleased with the results thus far. With full control of our product roadmap, we’ve been able to quickly add new features and betting markets to the score bat, including our own same game parlay offering, which has led to a noticeable increase in hold,” said Snowden.

Snowden also noted that Canada had even higher cross-sell between casino and sportsbook compared to the US, which has them optimistic about their growing share of the online casino market. Here is a look at the Canadian outlook from the presentation:

Barstool Sportsbook did come into the discussion in the look ahead to 2023. The company is confident the tech migration to a single stack, as is the case with theScore, will also lead to positive results in the US.

“We are also taking steps behind the scenes to better connect our brands from a marketing perspective and to provide a more seamless omnichannel experience for our customers, which we think can have a meaningful impact on both our retail and online casino offerings,” Snowden added.

Snowden admitted Barstool market share “softened

Snowden admitted that Barstool’s market share could improve, but noted this is also because they are focused on the integrated tech stack more than the existing product.

“Where we have not been focusing, understandably, is the platforms that we run on here in the US, which are third party platforms. We have not been able to throw the resources at those to innovate and iterate and really focus on enhancements so we’ve fallen a bit behind and I think our market share in sports betting this fall, and this winter here in the US, has softened up a little bit.”

The group is seeing success marketing to the existing mychoice rewards database, which contributed to 50% of handle so far in Ohio.

Ohio best launch for Barstool Sportsbook yet

Like others in the gaming space, Ohio was an exceptionally successful launch for the company and a great start to the year. Snowden said it was the most successful Barstool Sportsbook launch yet, but did add it was unfortunate not to be able to take action on the Ohio State vs Georgia National Championship semifinal.

The results in Ohio were reassuring for Penn Entertainment, which remains committed to its low-CPA acquisition strategy. The company hopes for a similar performance when online sports betting launches in Massachusetts in March.

What is also helping the interactive division’s bottom line is its market access partnerships. Of the $208 million in revenue for the quarter, almost $83 million came from gaming tax reimbursements from third-party skin partners.