At the end of 2020, the Chilean Ministry of Finance announced a new bill to regulate online gambling. However, since that date, there has been a lot of back and forth about the regulation of the online sports betting industry.

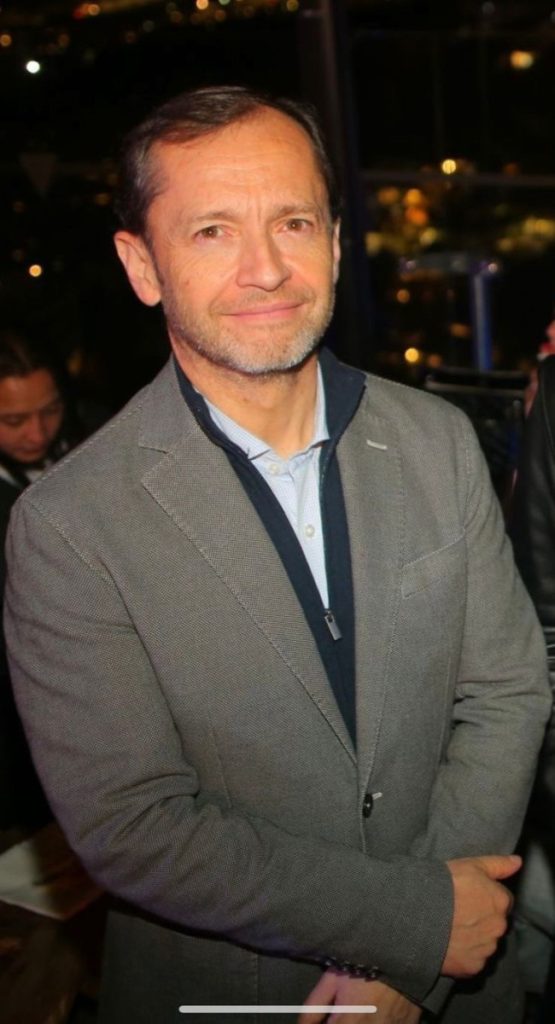

Carlos Baeza, Founder of CARLOS BAEZA Y CIA. ABOGADOS and Director of Latamwin Group, breaks down the impending regulations before discussing whether this Latin American market could become the region’s next powerhouse.

SBC: So Chile is quite close to approving igaming and sports betting regulations, after a long few months of too-ing and fro-ing. Can you give us an update of what the current state of play is in Chile?

CB: On March 7 this year, a regulation bill was presented to Congress, and it is currently under analysis by the Economy Commission of the Chamber of Deputies. It is difficult to make a forecast, but it is unlikely that this bill will become law in the short term. Hopefully late 2023, or early 2024.

SBC: For those that might not know, why has it been such an arduous process to introduce such regulations?

CB: At the end of 2020, the Ministry of Finance announced that a bill to regulate online betting platforms would be presented to the Chilean Congress. This is a matter under the exclusive initiative of the President of the Republic. Since the regulation bill was presented it hasn’t been that long. The Congress has just started the analysis and we hope it won’t be that arduous.

SBC: What impact is the introduction of sports betting and igaming legislation going to have for the land-based casinos? Could the government give priority to the land-based companies to operate in the online space, or will it be a case of market saturation as more operators become licensed?

CB: The bill establishes an open and competitive process for granting licenses, different and not connected with land base casino operation licenses. The bill does not set a pre-established number of licenses. It will be an open market in which any company that meets the requirements can apply.

SBC: What will licensed operators have to do to ensure that they can effectively compete against gray market sportsbooks?

CB: The bill will also grant the Chilean authorities more tools in order to act against the gray market, tools that they don’t have now. The possibility to lock domains, lock payments, and some others. The licensed operators will be more protected.

SBC: Critics have previously claimed that a review of proposed legislation is needed to provide a sufficient tax framework for Chile’s online gambling industry. With that in mind, will local and foreign operators be subject to the same tax rates? Or will there be a few discrepancies?

CB: The bill settles as an obligation that the licenses will only grant to Chilean shareholder companies, and doesn’t have many chances to change. Companies that will be interested in the Chilean market will be forced to incorporate a Chilean company.

SBC: Where do you see the Chilean market heading in the next five years? Does it have what it takes to become a powerhouse across LatAm?

CB: Chile has a great possibility of being a regulated market in the next few years. With this regulation in place and considering that Chile has one of the highest per capita incomes and the highest bank usage rate in the region (75% aprox); for sure will be a very interesting market.