TheWolfLine is driving a sports betting paradigm shift from the current ‘keep the customer dumb’ approach to a future where players are more educated and analytically equipped.

Greg Wolfe, CEO and Co-Founder, talks us through the inception and recent history of TheWolfLine, the only company combining quantitative and technical analysis for sports betting markets with ‘execution’ of the trading element.

He explains how he has been trying to get the ‘archaic’ sports betting industry to ‘get it’, before highlighting an important term in the TheWolfLine vision – gamification economics.

SBC Americas: Hi Greg, thank you for talking to us. First of all, what is your background? And how did this lead to your work at TheWolfLine?

Greg Wolfe: On a general level, I come from both the financial trading world and the gambling world. I spent many years trying to disprove that there is no difference at all between the two, but to no avail, even for the most esoteric concepts.

Going back to the start, I grew up in a Philadelphia suburb in New Jersey where the art of speculation has been a part of the social fiber since birth. I made my first sports bet at age seven, and I was running a small local sports book operation at age 12.

By age 14, I was going nightly to the old Garden State Park horse track where I became fascinated by market mechanics and behavioral economics in a ‘zero sum’ brokerage model.

In my late 20s, having moved out to California, a lifelong sports betting and horse track friend who was working as a sell-side market maker on the old American Stock Exchange told me that I had to return to NJ to ‘do options trading’ and ‘it is just like being a bookie and I am making more money than I ever imagined’.

I started on a buy-side proprietary options desk for a firm out of NYC. I passed the exam to be one of the first Registered Market Makers on the International Securities Exchange (the first fully electronic options exchange in the US).

Throughout the 2000s, I worked as a trading educator, mentor and consultant, both for the retail sector and the hedge fund sector, specifically in quantitative/technical analysis, futures, theory, practical application, product development and anything else that was correlated.

During this time I also earned my Registered Investment Advisor license from the US Securities and Exchange Commission and the Financial Regulatory Authority and was qualified to be Chief Compliance Officer for any US-based Financial Advisory Company.

SBCA: If this takes us up to the late 2000s; how did TheWolfLine then come about?

GW: Basically, I became so disenchanted with traditional financial markets amid rampant manipulation and corruption that I left and created TheWolfLine, the world’s only fully functional quantitative/technical analytics platform for sports betting markets operating on a complete ‘apples to apples’ foundation.

In short, I just reversed what had happened in the 1990s and instead of applying sports betting principles to financial trading, I built out the model exclusively for sports betting. This was the inception of a term that you hear used often today called ‘gamification economics’.

I thought that I was 10 years late with being the vanguard of this complete paradigm shift in the business model, but it turns out that I was over 10 years early, so I have been trying to get this archaic, predatory industry to ‘get it’ ever since. I believe that we will soon see sports investment contracts offered in the same way as any other financial investment contract.

SBCA: So if we match the two ‘worlds’ against one another, where is gambling playing catch up to financial trading?

GW: Every financial broker dealer (e.g. Robinhood, Ameritrade, E-trade, Schwab, IBKR, etc) understands that platforms are defined by two parts. First the quantitative and technical analytics half (QA and TA), and second the execution half.

However, the sports broker dealers, market makers or bookmakers of the world only offer the execution half in whatever packaging that they choose.

We are very happy, therefore, to be the only company that offers the QA/TA half as well as extensive education that appeals to the theoretical and practical conflation of financial trading and sports betting.

SBCA: Why do you think the first half of this has traditionally been overlooked?

GW: The main reason for the QA/TA half of the BD model, and even more so for the exchange model, is to give the buy side customer objective, quantitative resources that encourage them to intelligently enter into the market by increasing the efficiency and efficacy of their decision making.

QA/TA users do not have to have any fundamental knowledge of the sports/leagues, etc. so this part of the model increases volume across all global cultural boundaries.

With the increased volume leading to tighter margins in the market, this is a model that makes everyone happy because the ‘buy side’ is paying lower costs and the ‘sell side’ is making more revenue from increased volume and engagement in offerings that never would have had engagement before.

SBCA: Where does the new offering engagement come from?

GW: Simply through more bets from quantitative reasoning than just ‘fans’ or ‘hunches’ from the analysis of fundamental data, which actually becomes irrelevant if it is publicly known and absorbed by the market.

SBCA: You also mentioned the ‘extensive education’ that appeals to both sides; what does this look like in terms of TheWolfLine offering?

GW: I’ll go one better and give you an example to explain this. Between the early-mid 1990s and the mid-late 2000s, volume on the NYSE increased over 2000% (20x) and margins went from 1/8 to .01. This was largely due to the education and provision of quantitative analytics to the retail buy side investor or trader. That is what TheWolfLine will do for sports betting securities markets – same church, different pew.

SBCA: If we expand on the example you were able to give for the education part, how does working with TheWolfLine translate into activity; do you have any numbers?

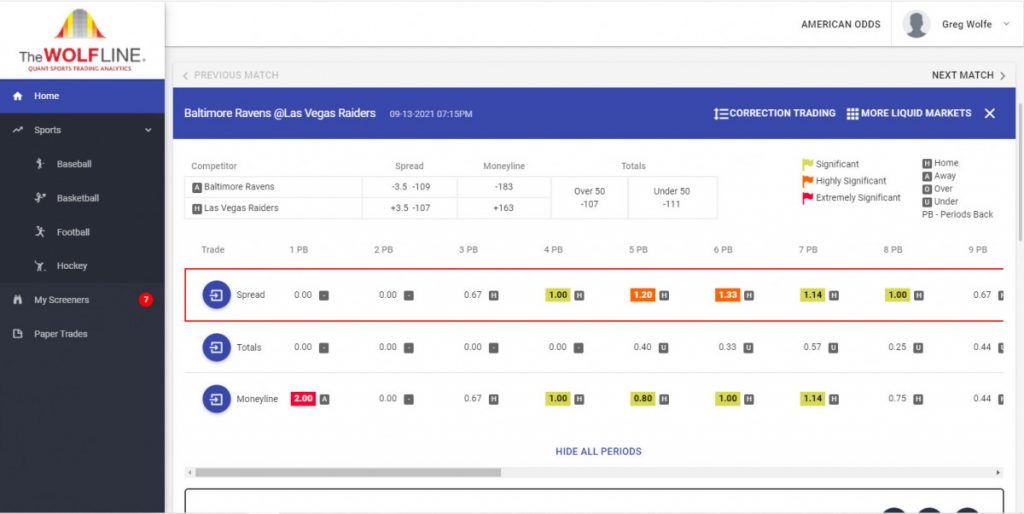

GW: We actually completed a ‘trade by trade study of a TheWolfLine client who lives in Las Vegas and, with zero trading experience, went from only a $100 to $200 a week bettor only during NFL season to a handle of almost $100,000 the following June purely from using TheWolfLine platform. It is anecdotal but that is how the quantitative model works. It is already proven, there is no way around it.

SBCA: What does the next few years hold for TheWolfLine and why should sportsbook operators be knocking on your door?

GW: TheWolfLine.com is, was, and always will be the leader in B2C and B2B professional quantitative analytics theories, products and platforms for the sports betting securities markets as billions of global financial traders inevitably move to sports markets and billions of global sports bettors move to financial trading.

The regulatory bodies will soon appropriately designate the sports contracts as securities, since they are based on their obvious allegory to options, which are always securities regardless of the underlying instrument as well as the equally obvious qualification as securities via SEC vs WJ Howey 1946 Supreme Court Decision in which Justice Frank Murphy is clearly talking about sports bets (and horses) being securities in his majority opinion without saying it.

TheWolfLine will change the paradigm from the current ‘keep the customer dumb, give them terrible markets, bet against them with illegal non public league data, and then ban them if they win’, which is ethically, legally and commercially untenable. Instead, the shift will be towards an educated, analytically equipped customer that leads to high volume.

These are multi-trillion $ regulated global securities markets. There is nothing ‘recreational’ about it anymore, where a smash and grab victimisation model is allowed to exist.

SBCA: Where is the service currently available?

GW: Due to the theories, products, platforms and functionality of TheWolfLine.com being a totally novel offering for this industry, the analytics and data is currently provided as a free service. At this time, only US markets are available, but since the data that are offered is purely quantitative and markets, sports, sectors or leagues are only distinguished by nuances of liquidity, all global leagues will soon be available.

Come into 2021. Stop allowing yourself to be exploited. Make your own professional analytic decisions and become a quantitative sports trader.

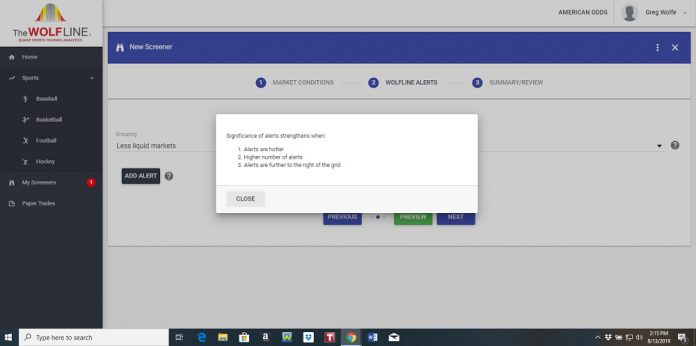

TheWolfLine platform has a very brief period of adoption and usability. The typical learning curve is similar to that of your first smartphone, depending on trading experience.

SBCA: Any final thoughts from your side?

GW: Just one thing as an afterthought which you might find interesting. This is the daily average retail volume on ETrade and Ameritrade for the last 20 years. It was flat at 1 million trades per day for 20 years and then happened to spike to 4 million in a hockey stick as soon as sports betting shut down.

This is not a coincidence by the way. Also, because of sports bettors moving to financials in 2020 and trying to get cheap margins by buying short dated At the Money calls, 2020 saw record options volume which was 68% higher than the previous record.

Robinhood doesn’t ‘democratise’ financial trading at all. TheWolfLine does though…through legitimate gamification economics.